IX Digital Asset Industry Classification System

(“DAICS®”)

The launch of the IX Digital Asset Industry Classification System (“DAICS®”), aiming to provide

the professional worldwide with a transparent and standardized classification scheme to determine sector and

exposure of particular digital assets. It also serves as a tool for asset allocation and portfolio analysis

for digital assets market as well as product development. DAICS® complements IX Capital

International to develop their own competitive digital asset indexes and index products from a robust global

standard.

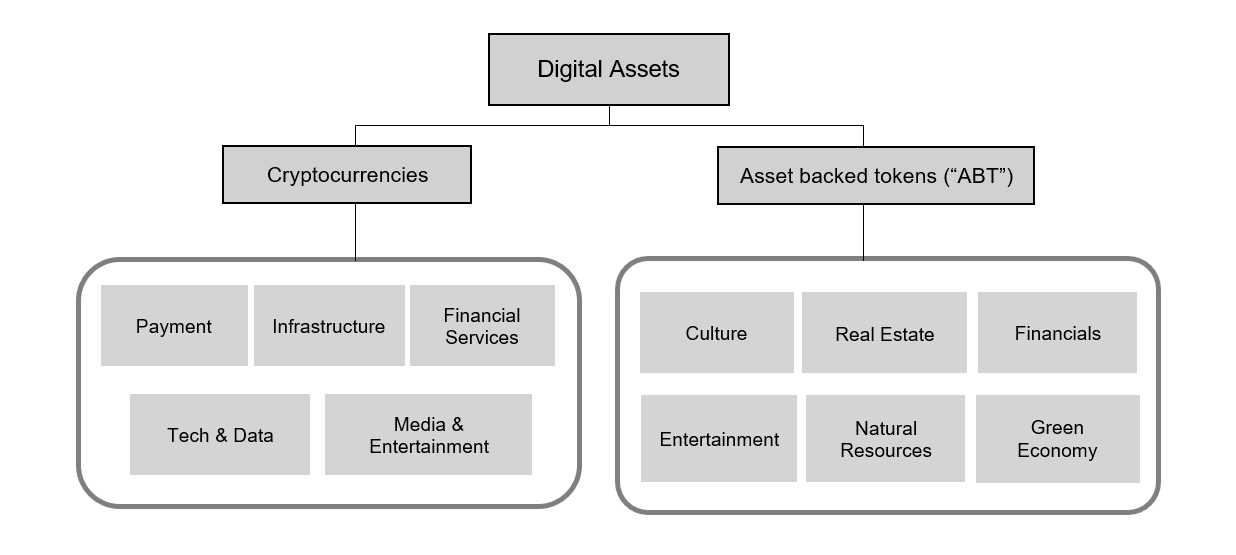

DAICS® covers both cryptocurrencies and asset-backed tokens (“ABT”), to be reviewed semi-annually

at the end of June and December. On the cryptocurrencies, it is a three-tier system that groups

cryptocurrencies into 5 main industries: 1) Payment, 2) Infrastructure, 3) Financial services, 4) Technology

& Data and 5) Media & Entertainment. These industries are further divided into 17 industry sectors, and

sub-sectors to be introduced in the future. Under asset-backed tokens, there are 6 asset types and 31

branches. They are: 1) Culture, 2) Real Estate, 3) Financials, 4) Entertainment, 5) Natural Resources and 6)

Green Economy.

Initially, DAICS® will only include the top-50(+n1) cryptocurrencies in terms of

market capitalization which already represent over 80% of the market share in terms of market size and

volume. ABT classification work will be added in the next stage when a fair population of popular

asset-backed tokens are available in the market. The current asset types and branches of the ABT category is

to provide a first stage according to more foreseeable industry demand. As the market further matures with

more cryptocurrencies with strong use cases emerge, the Classification System may expand to include more

cryptocurrencies, ABT, industries, sectors and subsectors.

In response to the common global effort to achieve net zero emission by 2030 and 2050 agenda for the 17

sustainable development goals (SDGs) by the United Nations, IX Capital International anticipates that more

tokenisation will adopt the SDGs. Our vision is that ESG and

sustainability is more than environmental impact, which also includes sustainable growth and development,

good governance, better social impact and community engagement. To promote this, the DAICS®

introduces “green” labelling for cryptocurrencies that adhere to the principle of sustainability by

employing energy efficient protocol or making an active effort in minimising environmental damages. Under

the ABT category, a “Green Economy” asset type is introduced for token that represent ownership of the

projects that ahere to the United Nations 17 sustainable development goals. An index which can represent the

Asia Pacific Green Economy is also under study.

More Information :

Overall Diagram

As of 2025 2H Review Result

{{ subsector }}

If you have any questions about the classifications, please contact daics@ix-index.com .